OUR STORY

Fortino Accounting Services was founded by Anthony Fortino with the goal of providing financial clarity and support to arts companies. Through tax services, bookkeeping, budget preparation, and other accounting services, Fortino Accounting Services provides financial confidence to both the clients they serve and the donors and investors that support their clients.

Fortino Accounting Services was started by Anthony Fortino with the goal of providing financial support and clarity to individuals and performing arts companies. Through tax return preparation and tax advisory, Fortino Accounting Services provides their clients financial confidence and peace of mind.

Our Story

CLIENTS INCLUDE

THEATRE

artists

ARTS consulting

DANCE

artsits

THEATRE producers

DANCE companies

TAX Services

Tax preparation services for individuals and corporations, specifically those in the performing arts industry. We can assist you in tax issues relating to deductions, credits, self-employment, rental income, non-resident state income, and more.

WE CAN PREPARE:

-

All personal US Federal income tax returns

-

All US state income tax returns

-

Non-Profit tax returns

-

S-Corp, C-Corp, Partnership returns

Tax software by Intuit Proconnect

User-friendly client portal

PRICING

-

Based on complexity

-

Base price starting at $250

-

Included in the base price is the tax return preparation, e-filing of the return, and an electronic copy of your return

-

Schedule C, non-resident states, itemized deductions, home office deduction, etc. are examples of items that increase the cost of a return

TIERS

-

SIMPLE: Form 1040 (Main Form), One W-2, One State: $250

-

STANDARD: Form 1040 (Main Form), Multiple W-2's, One State: $300

-

+SCHED C: All in Standard tier, plus a Schedule C (any qty): $400

-

EXTRA STATES: $25 / per state, up to 4 states, no additional charge beyond 4 states

-

TOUR PRICE: if you're on tour and have all of the above, 4+ states, price capped at: $550

-

BUSINESS RETURN: S-Corp, Partnership, Non-Profit, etc.: $500

GETTING STARTED

HOW IT WORKS

-

No appointment required

-

E-mail us at fortinotax@gmail.com, stating you would like help with your tax return

-

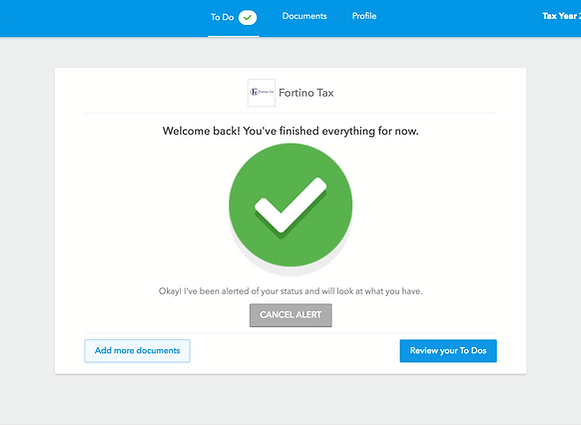

You will receive an informational packet along with an e-mail invitation to upload your tax documents to Intuit Link

-

Upon completion of your return, you will receive the following:

-

A copy of your tax return

-

E-file authorization forms to e-sign

-

An invoice with the amount owed for tax preparation services

-

NOTE: completion times may vary, dependent on promptness of e-mail communication and sufficiency of supporting documents

-

-

Once your invoice is paid, your return will be e-filed

2025 Tax Season Signup

-

To get started with your 2025 taxes, signup below and you will receive an e-mail with more information

From Clients

Gregory Patterson

Owner // Gregory Patterson Consulting

"Starting a small business can be a daunted enterprise. Starting a new nonprofit theatre company is even more complex... Anthony was so instrumental in making sure my clients were invoiced on time and my accounting was in top shape for tax time... Anthony is very responsive, detailed oriented, organized and has helped my companies in so many ways... Wouldn't recommend any other firm or person."